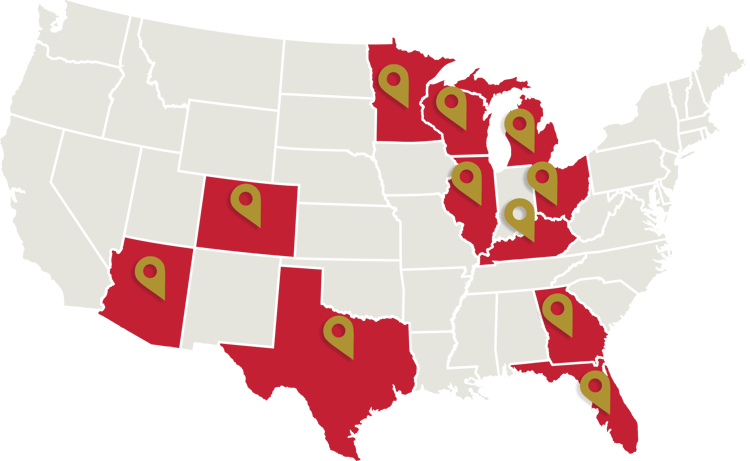

Continental Properties is a national real estate developer and property management firm with over 44 years of experience. Continental focuses on Class-A multifamily apartment communities in suburban markets, having developed 127 projects across 20 states. Our vertically integrated platform, national footprint, and focus on suburban garden-style multifamily communities has resulted in a long track record of maximizing values and delivering exceptional outcomes to investors.

Continental’s Income Funds consist of newly constructed, geographically diverse properties that are developed, stabilized, and operated by Continental. The Income Fund serves as a tax efficient investment with immediate, identified capital deployment for investors.

Contact Us

MULTIFAMILY HOMES OWNED / DEVELOPED

COMMUNITIES OWNED / DEVELOPED (ACROSS 19 STATES)

NMHC MULTIFAMILY DEVELOPER RANKING (2022)

GARDEN STYLE MULTIFAMILY DEVELOPER RANKING (2019)

COMMUNITIES / HOMES SOLD

TOTAL SALES VALUE REALIZED

INCOME FUNDS CLOSED

COMMUNITIES / HOMES MANAGED

PORTFOLIO VALUE

INCOME FUND EQUITY RAISED

*Past performance does not guarantee future results. Data from August 2023.

Continental uses a consistent, disciplined, and repeatable approach to development that fully utilizes our vertical integration. Our dedicated research team reviews markets across the U.S. on a systematic basis looking for strong demand drivers, favorable rental demographics, barriers to entry and other proprietary metrics correlated with successful performance. Due diligence, entitlement and permitting work is done by in-house personnel who understand Continental’s suburban product and risk tolerance. Our stringent approval process and underwriting parameters help to mitigate many of the risks associated with multifamily development projects.

This site is operated by Continental Properties (the “Company”). Securities offerings are speculative and involve substantial risks. Consider the risks outlined in the applicable investment offering documents before making any investment. Risks include, but are not limited to illiquidity, lack of diversification, complete loss of capital, default risk, and capital call risk. Investments may not achieve their objectives. Investors who cannot afford to lose their entire investment should not invest in such offerings. There is no guarantee that any stated valuations or other terms appearing on this website are accurate or in agreement with the market or industry terms or valuations.

The information and materials contained on this website do not constitute investment advice and are not intended to be an offer or solicitation of offers of investments. By accessing this site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy.

All Securities are offered through North Capital Private Securities, Member FINRA/SIPC, located at 623 East Ft. Union Blvd, Suite 101, Salt Lake City, UT 84047. NCPS does not make investment recommendations and no communication, through this website or in any other medium, should be construed as a recommendation for any Security offered on or off this investment platform. Please review North Capital’s Form CRS and its background on FINRA’s BrokerCheck. This website is intended solely for qualified investors.

© 2026 Continental Properties Company, Inc. | Privacy Policy | Terms of Use | Cookies Policy